The petrol station canopy represents one of the most valuable yet underutilized advertising platforms in modern retail fuel distribution. With millions of vehicles passing beneath these structures daily, forward-thinking fuel retailers are discovering that strategic advertising partnerships can transform construction expenses into profitable revenue streams. Industry analysis reveals that well-positioned petrol station canopy advertising can generate substantial returns, potentially offsetting initial infrastructure investments within remarkably short timeframes. This comprehensive examination explores the financial dynamics, implementation strategies, and market opportunities that make canopy advertising an increasingly attractive proposition for fuel station operators seeking to maximize their property's earning potential.

Revenue Generation Potential of Canopy Advertising

Market Value Assessment for Advertising Space

The advertising potential of a petrol station canopy depends heavily on location demographics, traffic volume, and visibility factors. Prime locations along major highways or urban arterial roads can command premium advertising rates ranging from £2,000 to £8,000 monthly per advertising panel. High-traffic locations serving 2,000 to 5,000 vehicles daily create exceptional exposure opportunities that national brands actively seek. The elevated position and extended dwell time at fuel stations provide advertisers with unique engagement advantages compared to traditional roadside billboards.

Geographic positioning significantly influences advertising revenue potential. Petrol station canopy installations near shopping centers, business districts, or residential areas typically attract local and regional advertisers willing to pay competitive rates for sustained visibility. Market research indicates that well-positioned canopy advertising can achieve cost-per-thousand-impressions rates comparable to digital advertising platforms, making them attractive investments for advertisers seeking tangible, physical presence in target markets.

Long-term Contract Benefits and Stability

Establishing long-term advertising partnerships provides predictable revenue streams that facilitate accurate financial planning and cost recovery projections. Many successful petrol station canopy advertising arrangements involve multi-year contracts with automatic renewal clauses, ensuring consistent income flow throughout the payback period. These stable partnerships often include annual rate increases tied to inflation or market performance metrics, protecting operators against currency devaluation and rising operational costs.

Contract stability becomes particularly valuable when calculating return on investment timelines. Guaranteed advertising revenue over 24 to 36-month periods allows operators to confidently project cash flows and determine whether construction costs can realistically be recovered within the desired timeframe. Professional advertising management companies often facilitate these arrangements, handling client acquisition, contract negotiations, and ongoing relationship management while providing operators with hassle-free revenue generation.

Construction Cost Analysis and Investment Recovery

Initial Capital Requirements and Infrastructure Costs

Modern petrol station canopy construction involves substantial upfront investments encompassing structural engineering, materials, installation, and regulatory compliance costs. Typical installations range from £150,000 to £400,000 depending on size, complexity, and local building requirements. Advanced LED lighting systems, weatherproofing, and advertising display infrastructure add significant value while increasing initial capital requirements. However, these enhanced features directly contribute to advertising appeal and revenue generation potential.

The investment calculation must account for additional costs including planning permissions, utility connections, and ongoing maintenance requirements. Professional project management ensures compliance with health and safety regulations while optimizing construction timelines and cost control. Many operators discover that investing in premium materials and advanced lighting systems yields higher advertising rates and faster cost recovery, justifying increased upfront expenditure through enhanced revenue generation capabilities.

Financial Modeling and Payback Period Calculations

Accurate financial modeling requires comprehensive analysis of construction costs, financing expenses, operational overheads, and projected advertising revenues. Successful cost recovery within two years typically requires monthly advertising revenue exceeding £6,000 to £15,000, depending on initial investment levels and financing terms. These calculations must incorporate maintenance costs, insurance requirements, and potential vacancy periods between advertising contracts.

Conservative financial projections often assume 80-85% occupancy rates to account for contract transitions and seasonal advertising fluctuations. petrol station canopy investments demonstrating strong market positioning and professional management typically achieve higher occupancy rates and premium pricing, accelerating payback timelines and improving overall investment returns.

Market Positioning and Competitive Advantages

Strategic Location Selection and Traffic Analysis

Strategic location analysis forms the foundation of successful petrol station canopy advertising ventures. High-visibility locations with consistent traffic flow throughout business hours provide optimal advertising exposure and justify premium pricing structures. Professional traffic studies quantify vehicle counts, demographic profiles, and peak usage patterns, enabling accurate revenue projections and advertiser targeting strategies.

The competitive landscape influences both construction decisions and advertising pricing strategies. Markets with limited outdoor advertising inventory often support higher rates and faster client acquisition, improving cost recovery prospects. Conversely, saturated markets may require enhanced features, competitive pricing, or specialized targeting approaches to achieve desired occupancy and revenue levels. Understanding local advertising dynamics ensures realistic financial projections and appropriate investment sizing.

Technology Integration and Modern Advertising Solutions

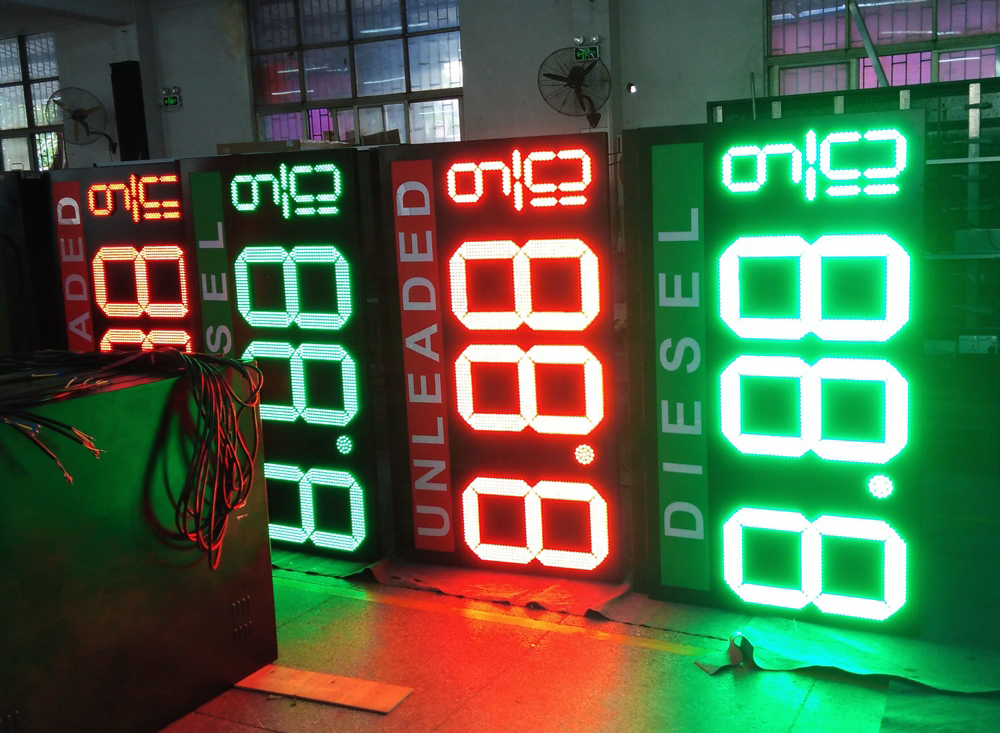

Contemporary petrol station canopy installations increasingly incorporate digital display technology, LED lighting systems, and smart advertising management platforms. These technological enhancements command premium advertising rates while providing clients with dynamic content capabilities, real-time campaign management, and detailed performance analytics. Digital integration often justifies 30-50% higher advertising rates compared to static installations.

Smart technology integration enables sophisticated advertising programs including daypart scheduling, weather-responsive content, and demographic targeting based on traffic patterns. These capabilities attract premium advertisers seeking advanced marketing solutions, supporting higher revenue generation and faster investment recovery. The operational efficiency gains from automated systems also reduce ongoing management costs, improving overall profitability and shortening payback periods.

Risk Management and Success Factors

Market Risk Assessment and Mitigation Strategies

Successful petrol station canopy advertising ventures require comprehensive risk assessment and appropriate mitigation strategies. Market risks include economic downturns affecting advertising spending, regulatory changes impacting outdoor advertising, and increased competition reducing pricing power. Diversified client portfolios spanning multiple industries and contract durations help minimize exposure to sector-specific downturns and maintain consistent revenue streams.

Professional market research identifies local advertising demand, competitive positioning, and growth prospects before committing to substantial construction investments. Understanding seasonal variations, economic sensitivities, and regulatory environments enables more accurate financial projections and appropriate contingency planning. Many successful operators establish reserve funds covering 6-12 months of operating expenses to weather temporary market disruptions while maintaining advertiser relationships.

Operational Excellence and Client Retention

Maintaining high-quality petrol station canopy installations requires ongoing attention to structural integrity, lighting performance, and advertising display quality. Regular maintenance schedules preserve advertiser satisfaction while protecting the long-term asset value and revenue generation potential. Professional property management ensures consistent presentation standards and rapid response to maintenance issues that could impact advertiser relationships.

Client retention significantly influences cost recovery timelines and overall profitability. Successful operators prioritize advertiser satisfaction through responsive service, competitive pricing, and performance reporting. Long-term client relationships reduce marketing costs, minimize vacancy periods, and often justify annual rate increases that enhance overall investment returns. Building strong industry relationships also facilitates referral business and easier contract renewals.

Industry Trends and Future Opportunities

Evolution of Outdoor Advertising Markets

The outdoor advertising industry continues evolving toward more sophisticated, technology-enabled solutions that command premium pricing and deliver enhanced advertiser value. Petrol station canopy installations benefit from these trends through increased advertiser interest in location-based marketing, digital integration opportunities, and growing appreciation for physical advertising presence complementing digital campaigns.

Emerging technologies including programmatic advertising, real-time content optimization, and integrated mobile marketing create new revenue opportunities for modern petrol station canopy installations. These advanced capabilities often justify significant premium pricing while attracting technology-forward advertisers seeking innovative marketing solutions. Early adopters of these technologies frequently achieve faster cost recovery and higher long-term returns compared to traditional static installations.

Sustainability and Environmental Considerations

Environmental sustainability increasingly influences both construction decisions and advertiser selection criteria. Energy-efficient LED lighting systems, solar power integration, and sustainable construction materials appeal to environmentally conscious advertisers while reducing operational costs. These features often justify premium pricing while demonstrating corporate responsibility commitments that attract quality long-term advertising partners.

Green building certifications and environmental compliance can differentiate petrol station canopy installations in competitive markets while accessing specialized advertising segments focused on sustainability messaging. The operational cost savings from energy-efficient systems also contribute to improved profitability and faster investment recovery, making environmental considerations both commercially and ethically beneficial.

FAQ

What factors most significantly influence advertising revenue potential for petrol station canopy installations

The primary factors affecting advertising revenue include location traffic volume, demographic characteristics of passing motorists, visibility from major roadways, and local advertising market conditions. High-traffic locations with affluent demographics and limited competing outdoor advertising inventory typically command the highest rates. Professional traffic studies and market analysis help establish realistic revenue projections before construction begins.

How do financing options affect the feasibility of achieving two-year cost recovery

Financing terms significantly impact cash flow requirements and overall cost recovery timelines. Lower interest rates and longer amortization periods reduce monthly debt service, making cost recovery more achievable with modest advertising revenues. However, total financing costs may extend overall payback periods beyond two years when considering total investment recovery including interest expenses. Cash purchases often enable faster cost recovery despite higher upfront capital requirements.

What ongoing operational costs should be considered when projecting investment returns

Ongoing operational expenses include regular maintenance, lighting electricity costs, insurance premiums, property taxes, and advertising management fees. Professional installations typically require 10-15% of gross advertising revenue for maintenance and operational expenses. These costs must be factored into financial projections to ensure realistic cost recovery calculations and sustainable long-term profitability.

How does digital advertising integration affect construction costs and revenue potential

Digital display integration increases initial construction costs by £50,000 to £150,000 but typically enables 30-50% higher advertising rates compared to static installations. The enhanced revenue potential often justifies additional upfront investment through faster cost recovery and improved long-term returns. Digital capabilities also attract premium advertisers and enable dynamic pricing strategies that maximize revenue optimization throughout varying market conditions.

Table of Contents

- Revenue Generation Potential of Canopy Advertising

- Construction Cost Analysis and Investment Recovery

- Market Positioning and Competitive Advantages

- Risk Management and Success Factors

- Industry Trends and Future Opportunities

-

FAQ

- What factors most significantly influence advertising revenue potential for petrol station canopy installations

- How do financing options affect the feasibility of achieving two-year cost recovery

- What ongoing operational costs should be considered when projecting investment returns

- How does digital advertising integration affect construction costs and revenue potential